Sales Tax Calculator

Purchasing and selling are common things these days. Now sale taxes are commonly charged for every product. It is difficult to manually calculate the sale tax but now it’s easy due to the online sale tax calculator.

Steps of Sales Tax Calculator Online

Follow these steps to get accurate sale taxes in seconds;

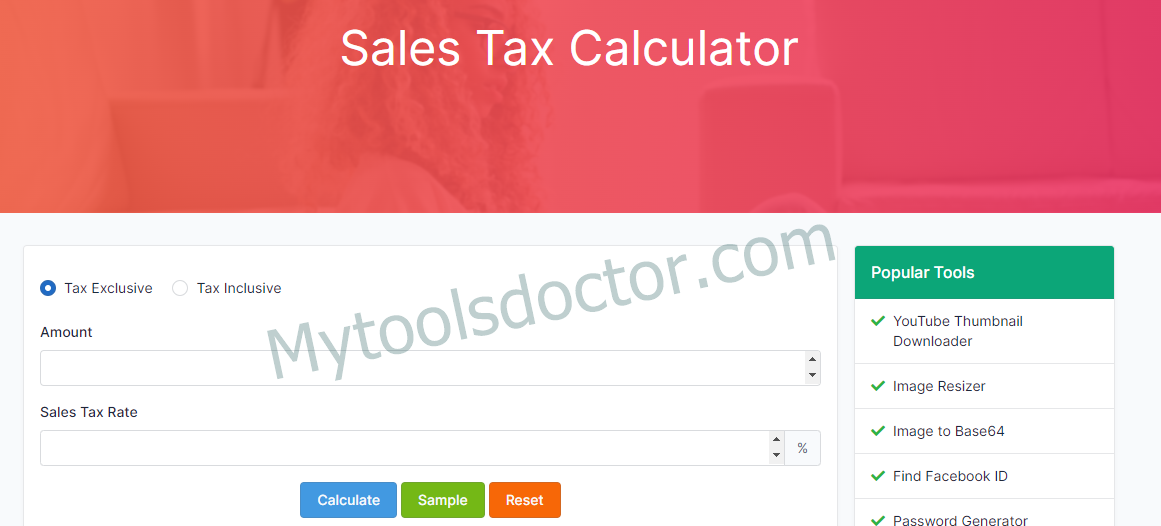

- Open the link https://mytoolsdoctor.com/sales-tax-calculator. A screen like this open.

- Select the way of finding the sale tax that is “Tax Inclusive” or “Tax Exclusive”.

- Enter the amount of the product.

- Enter the tax percentage that is applied to a product.

- Click the calculate button and it calculates the sale text.

Sale Tax Exclusive Results

Sale Tax Inclusive Result

Inputs of the sale tax calculator

The sale tax calculator inputs the following values;

- Select that the Gross amount is calculated by “Including tax” or “Excluding Tax”.

Sale Tax Exclusive:

it means that the price is without the tax. In this way, the inputted amount is the gross price.

Sale Tax Inclusive:

it means that the price includes the tax. In this way, the sale tax amount is added to the inputted value and that’s become the gross amount.

- The price or amount of the product.

- The sale tax percentage that is applied to such products.

You can also visit this tool PayPal Fee Calculator

Outputs of the sale tax calculator

The sale tax calculator Outputs the following values;

Net Amount

It is the actual price of the product that doesn’t contain any tax.

Tax Rate

It is the amount of sale tax that is calculated by the sale tax percentage.

Gross Amount

It is the price of the product that is calculated by the sum of the net amount and tax rate.

Gross price = Net Price + Sales Tax

Sale Tax = Gross Price – Net Price